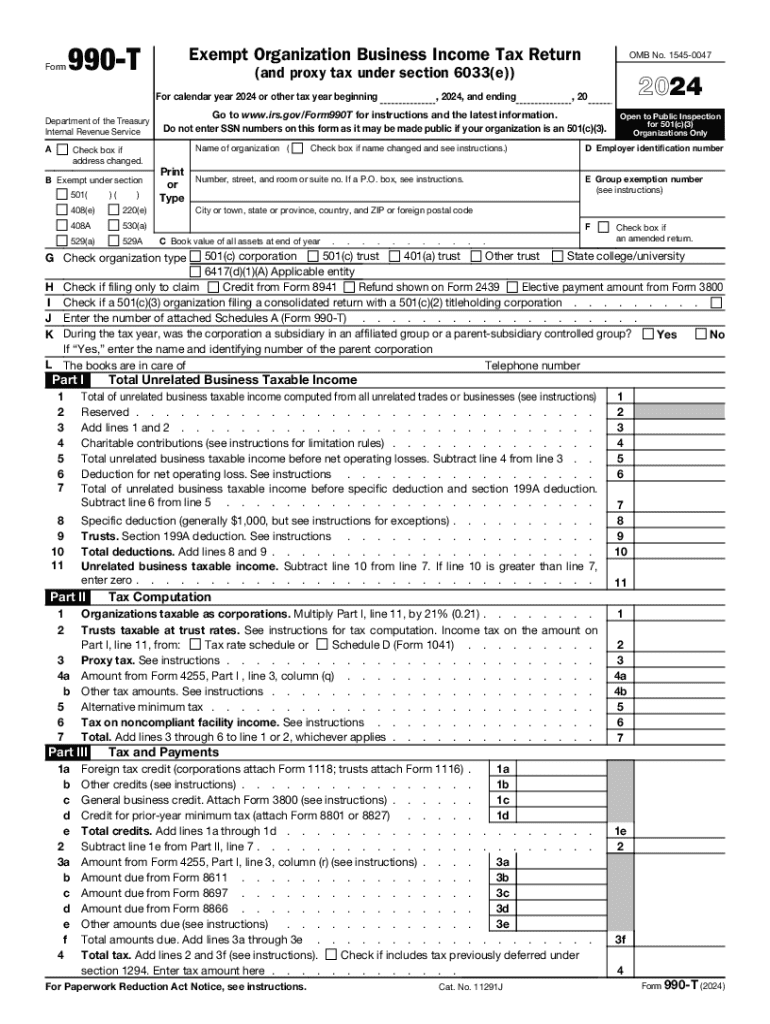

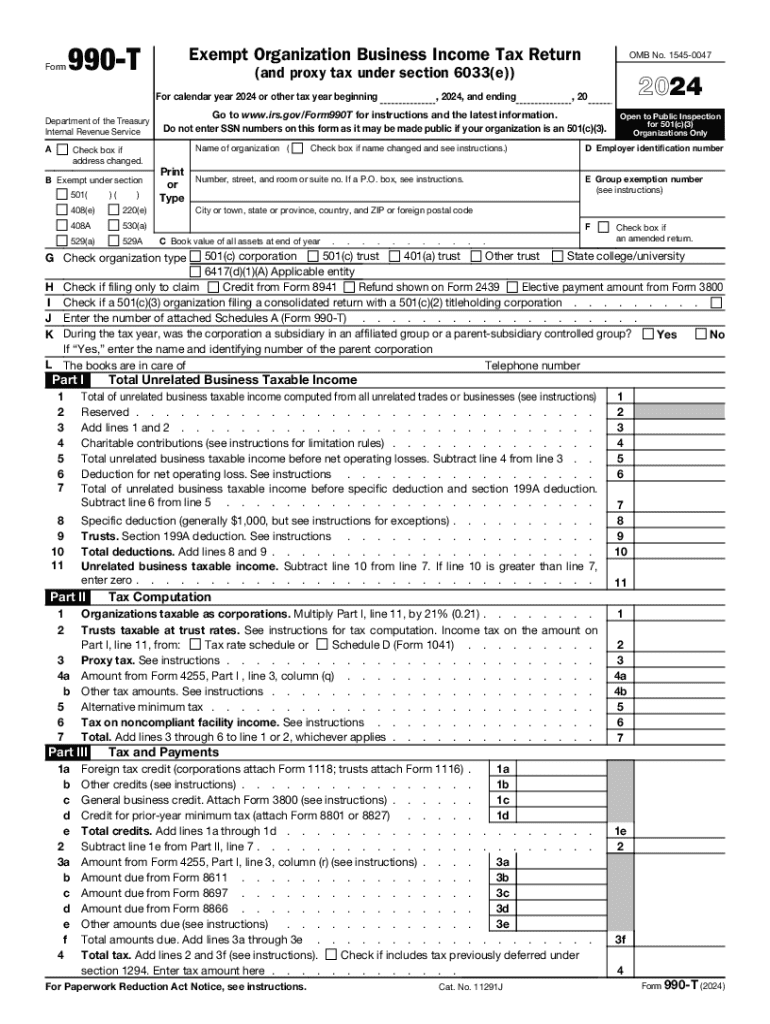

IRS 990-T 2024-2025 free printable template

Get, Create, Make and Sign irs 990 t form

How to edit 990 t online

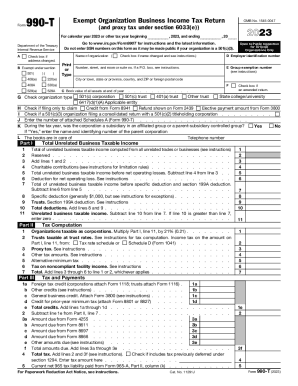

IRS 990-T Form Versions

How to fill out 990 form

How to fill out IRS 990-T

Who needs IRS 990-T?

Video instructions and help with filling out and completing form 990

Instructions and Help about tax year

Hi this is Jared Lopez sales marketing coordinator for next generation trust services in an effort to maintain our reputation is the most customer friendly self-directed IRA administrator next generation is sending out reminder letters to our clients that if you have debt on your IRA asset, and it generates income you must file Form 990 t if you have any questions you can email the office at info at next generation trust calm or dial 8888 5780 58

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 t to be eSigned by others?

How can I get form 990 t?

Can I edit form 990 t on an Android device?

What is IRS 990-T?

Who is required to file IRS 990-T?

How to fill out IRS 990-T?

What is the purpose of IRS 990-T?

What information must be reported on IRS 990-T?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.